Master of Science in International Accounting and Finance (Accredited by ACCA, UK)

Master of Science (MSc) in International Accounting and Finance is designed for students from any discipline who are looking to gain a globally recognized and accredited accounting qualification. With an ACCA Accredited Program, offering the highest level of ACCA exemptions, and a certification from PwC Academy, you'll fast-track your professional development, preparing you for key roles in finance, auditing, and accounting across global markets.Whether you're aiming to work in multinational corporations or pursue professional accounting qualifications, this program provides the skills and credentials to succeed in today’s interconnected business world.

-

TypeMaster's degree

-

Start DateMarch 31, 2026

-

Duration12 Months

.webp)

.webp)

- Institution of Eminence by MOE, Govt. of India

Master of Science in International Accounting and Finance (Accredited by ACCA, UK)

Course Snapshot

-

15

Courses

-

13 ACCA

Modules Covered

-

Highest Number

of Paper Exemptions

- Ace international accounting and finance concepts

- Get a Master’s degree in 1 Year

- Attend 120+ hours of live sessions with stellar faculty

- Watch 150+ hours of recorded video content

.webp)

International Accounting and Finance (Accredited by ACCA, UK)

What does this course have to offer?

Key Highlights

-

Master’s Degree from the #1 Private University in India as per QS Rankings 2023

-

ACCA-Readiness with Highest Level of Exemptions

-

Learn Financial Analytics from PwC experts (with Power BI)

-

Blended Learning with Live & Recorded Classes

-

Learn from world-class university professors

- Save on ACCA Exam Fee via Exemptions

-

1 of only 4 private Indian institutes recognised as ‘Institution of Eminence’ by MoE, Govt. of India

Who Is This Programme For?

-

Working professionals and students who wish to pursue a career in International Accounting or in Banking or Financial Services

- Finance Professionals: Individuals currently working in accounting or finance function, banking, investment, or financial services industry seeking to advance their career.

- Business Graduates: Those with a bachelor’s degree in Commerce, Finance, Business, Economics, Mathematics, Statistics or related areas aiming to specialize in accounting or finance.

- Career Changers: Professionals from other sectors looking to transition into accounting and finance.

Eligibility Criteria

-

A valid undergraduate degree with a minimum of 50% marks

-

Learners with less than 50% marks in their undergraduate degree need to take an admissions test

Overview of Master’s Degree in International Accounting and Finance (Accredited with ACCA, UK)

Earn a Master’s Degree in Finance and an ACCA Qualification in just 12 months with the online Accounting and Finance program from O.P. Jindal Global University (JGU) – India’s #1 private university (QS World University Rankings 2021, 2022, and 2023).

Earn a Master’s Degree in Finance and an ACCA Qualification in just 12 months with the online Accounting and Finance program from O.P. Jindal Global University (JGU) – India’s #1 private university (QS World University Rankings 2021, 2022, and 2023).

This one-year MS in International Accounting and Finance program is accredited with the prestigious ACCA (Association of Chartered Certified Accountants) qualification. It offers the highest level of exemptions towards ACCA qualification.

What sets this online master's degree in finance apart is its industry-aligned approach, enriched by a Financial Analytics certification from PwC Academy. You’ll gain advanced financial leadership skills in accounting and data-driven decision-making, positioning you for global accounting careers in financial management, audit, and strategic leadership.

With the combined credibility of JGU, the international recognition of ACCA, and the industry relevance of PwC, this finance leadership degree is designed to fast-track your journey to becoming a sought-after financial professional.

Key Program Highlights

- Dual Credentials: Earn a Master’s degree from O.P. Jindal Global University (JGU) and a Financial Analytics certification from PwC Academy, enhancing your professional profile.

- ACCA Accreditation: Fast-track your ACCA qualification by getting the highest level of exemptions towards ACCA qualification.

- Global Recognition: JGU, recognized as an “Institution of Eminence” by the Ministry of Education, Government of India, has been ranked as India’s #1 Private University in the QS World University Rankings for 2021, 2022, and 2023.

- Industry-Aligned Curriculum: Cover essential areas like financial reporting, audit, taxation, and strategic business management, mapped to ACCA’s global standards.

- World-Class Faculty: Learn from JGU faculty with decades of experience in finance, accounting, and analytics.

- Flexible Learning Format: 100% online + benefit from recorded lectures, weekly live sessions, and access to JGU’s comprehensive digital library.

- Global Career Prospects: Join a network of over 233,000 ACCA members and access job opportunities in 110+ countries.

- Career Support Services: Utilize upGrad’s career resources, including AI-powered resume building and interview preparation.

Accounting and Finance Degree

Earn the Prestigious Master’s Degree from JGU

- MSc. in International Accounting and Finance

Earn a recognized MSc in International Accounting and Finance to elevate your career and navigate the global financial landscape. - Degree from an Institution of Eminence

O.P. Jindal Global University is one of the 4 private universities in India recognised as an Institution of Eminence by MOE, Govt. of India. - Lifetime Value

Your master’s credentials represent a lifelong investment in your finance and accounting career.

International Accounting and Finance Instructors

Whom Will You Learn From?

-

12 Instructors

12 Instructors

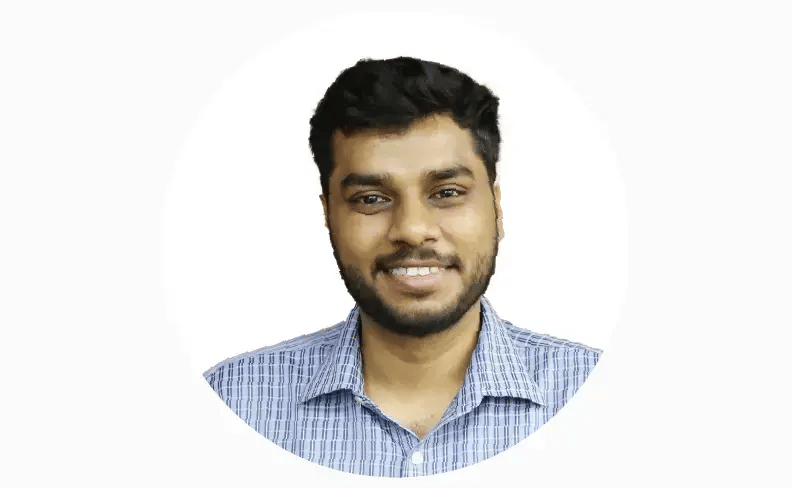

Prof. Ram B. Ramachandran

Professor and Vice Dean

Professor and Vice Dean-

PhD Candidate, ISM Paris | Former Managing Director at EY, New York | Worked with PwC, Prudential Insurance, and Merill Lynch in the US

PhD Candidate, ISM Paris | Former Managing Director at EY, New York | Worked with PwC, Prudential Insurance, and Merill Lynch in the US

Read More

Prof. (Dr.) Hemant Manuj

Professor and Executive Dean

Professor and Executive Dean-

PhD from IIM-C | Associate of the Institute of Cost & Works Accountants of India | Certified FRM

PhD from IIM-C | Associate of the Institute of Cost & Works Accountants of India | Certified FRM

Read More

Chavi Asrani

Associate Professor

Associate Professor-

PhD from IIT Delhi | Masters in Economics with a Gold medal from Loyola College

PhD from IIT Delhi | Masters in Economics with a Gold medal from Loyola College

Read More

Dr. Kewal Singh

Assistant Professor

Assistant Professor-

PhD from IIT Kanpur | Qualified the Junior Research Fellowship (JRF) awarded by UGC, Government of India

PhD from IIT Kanpur | Qualified the Junior Research Fellowship (JRF) awarded by UGC, Government of India

Read More

Dr. R Saravanan

Assitant Professor

Assitant Professor-

PhD from NIT Kurukshetra | Previously worked as Academic Associate in ISB, Hyderabad

PhD from NIT Kurukshetra | Previously worked as Academic Associate in ISB, Hyderabad

Read More

Ashaawari Datta Chaudhuri

Lecturer

Lecturer-

Practicing Advocate in Delhi High Court | LLM fromNational University of Singapore

Practicing Advocate in Delhi High Court | LLM fromNational University of Singapore

Read More

Dr. Anurag Banerjee

Assistant Professor

Assistant Professor-

PhD and Mphill in Banking from the University of Calcutta | Former Teaching Assistant at IIM-C and IIM-V

PhD and Mphill in Banking from the University of Calcutta | Former Teaching Assistant at IIM-C and IIM-V

Read More

Dr. Rupesh Sharma

Assistant Professor

Assistant Professor-

PhD from IIM Trichy | Former Assistant Professor at University of Delhi

PhD from IIM Trichy | Former Assistant Professor at University of Delhi

Read More

-3fafbb991b284eed9ce3289086428de4.webp?width=792&height=488&name=Deeksha20(1)-3fafbb991b284eed9ce3289086428de4.webp)

Dr. Deeksha Garg

Assistant Professor

Assistant Professor-

PhD from GJU | MCom from University of Delhi | Former Assistant Professor at Christ University

PhD from GJU | MCom from University of Delhi | Former Assistant Professor at Christ University

Read More

Prof. Mohd. Kashif Ansari

Assistant Professor

Assistant Professor-

MPhil from Delhi School of Economics, University of Delhi | Recepient of the Award of Junior Research Fellowship

MPhil from Delhi School of Economics, University of Delhi | Recepient of the Award of Junior Research Fellowship

Read More

Prof. (Dr.) Tarun Dhingra

Assistant Professor

Assistant Professor-

PhD from MNNIT | 26+ Years of Experience | Co-authored 80+ Research Publications

PhD from MNNIT | 26+ Years of Experience | Co-authored 80+ Research Publications

Read More

Prof. (Dr.) Amlan Das Gupta

Associate Professor & Associate Dean

Associate Professor & Associate Dean-

Dr. Amlan Das Gupta, a Development Economist, holds a Master's in Quantitative Economics from ISI Delhi and a PhD from the University of British Columbia.

Dr. Amlan Das Gupta, a Development Economist, holds a Master's in Quantitative Economics from ISI Delhi and a PhD from the University of British Columbia.

Read More

Program Curriculum (Accredited by ACCA, UK)

Learn with a World-Class Curriculum

Course 1: Business & Technology

Gain knowledge and understanding of business, its environment, and people.

Gain knowledge and understanding of business, its environment, and people.

Topics Covered:

- Business Organization & External Environment

- Organisational Structure, Culture & Governance

- Business Functions, Regulation & Technology

- Leadership & Management

- Personal Effectiveness & Communication

- Professional Ethics

Course 2: Financial Maths and Statistics

Equip students with the essential mathematical and statistical tools required for advanced studies in finance and accounting.

Equip students with the essential mathematical and statistical tools required for advanced studies in finance and accounting.

Topics Covered:

- Financial Mathematics

- Value of Money, Annuities and Bond Pricing

- Introductory Derivatives and Their Applications in Finance

- Descriptive and Inferential Statistics

- Correlation and Regression Analysis

Course 3: Financial Economics

Understand the global financial system, focusing on the roles, functions, and dynamics of financial markets and institutions.

Understand the global financial system, focusing on the roles, functions, and dynamics of financial markets and institutions.

Topics Covered:

- Structure and Purpose of Financial Markets

- Valuation of Financial Instruments

- Role of Global Financial Institutions

- Market Dynamics (Price Discovery, Liquidity, Risk)

- Causes and Consequences of Global Financial Crises

Course 4: Financial Accounting

Develop knowledge of financial accounting principles and technical proficiency in double-entry bookkeeping.

Develop knowledge of financial accounting principles and technical proficiency in double-entry bookkeeping.

Topics Covered:

- Context & Purpose of Financial Reporting

- Accounting Principles & Concepts

- Double-Entry Bookkeeping & Accounting Systems

- Recording Transactions & Events

- Reconciliations & Trial Balance

- Preparing & Interpreting Financial Statements

Course 5: Management Accounting

Develop knowledge of management accounting techniques for planning, controlling, and performance monitoring.

Develop knowledge of management accounting techniques for planning, controlling, and performance monitoring.

Topics Covered:

- Management Information & Cost Classification

- Budgeting & Forecasting Techniques

- Material, Labour & Overhead Accounting

- Absorption, Marginal & Activity-Based Costing

- Job, Batch & Process Costing

- Target & Life-Cycle Costing

- Standard Costing & Performance Measurement

Course 6: Financial Reporting

Develop skills in applying IFRS® Standards and preparing financial statements for entities and groups.

Develop skills in applying IFRS® Standards and preparing financial statements for entities and groups.

Topics Covered:

- Conceptual & Regulatory Framework for Financial Reporting

- Accounting for Transactions

- Financial Statement Analysis & Interpretation

- Preparation of Financial Statements for Entities & Groups

- Employability & Technology Skills

Course7: Corporate & Business Law

Develop knowledge of the legal framework and specific legal areas related to business.

Develop knowledge of the legal framework and specific legal areas related to business.

Topics Covered:

- Legal System & Law of Obligations

- Employment Law

- Business Organization Formation & Constitution

- Capital & Financing of Companies

- Company Management, Administration & Regulation

- Insolvency Law

- Corporate Fraudulent & Criminal Behaviour

Course 8: Performance Management

Enhance your understanding of managing business performance, building on management accounting principles.

Enhance your understanding of managing business performance, building on management accounting principles.

Topics Covered:

- Management Information Systems & Data Analytics

- Specialist Cost & Management Accounting Techniques

- Decision-Making Techniques

- Budgeting & Control

- Performance Measurement & Control

- Employability & Technology Skills

Course 9: Financial Management

Equip yourself with the knowledge and skills needed for making investment, financing, and dividend policy decisions.

Equip yourself with the knowledge and skills needed for making investment, financing, and dividend policy decisions.

Topics Covered:

- Financial Management Function & Environment

- Working Capital Management

- Investment Appraisal

- Business Finance & Valuation

- Risk Management

- Employability & Technology Skills

Couse 10: Audit & Assurance

Understand the nature, purpose, and scope of assurance engagements, including statutory audits and professional ethics.

Understand the nature, purpose, and scope of assurance engagements, including statutory audits and professional ethics.

Topics Covered:

- Audit Framework & Regulation

- Planning & Risk Assessment

- Internal Control

- Audit Evidence

- Review & Reporting

- Employability & Technology Skills

Course 11: Taxation

Develop knowledge of the UK tax system and its application to individuals, companies, and groups.

Develop knowledge of the UK tax system and its application to individuals, companies, and groups.

Topics Covered:

- UK Tax System & Administration

- Income Tax & NIC Liabilities

- Chargeable Gains for Individuals

- Inheritance Tax

- Corporation Tax Liabilities

- Value Added Tax (VAT)

- Employability & Technology Skills

Course 12: Strategic Business Reporting

Discuss and evaluate the principles behind corporate reporting and ethical management stewardship.

Discuss and evaluate the principles behind corporate reporting and ethical management stewardship.

Topics Covered:

- Ethical & Professional Principles

- Financial Reporting Framework

- Reporting Financial Performance of Entities

- Group Financial Statements

- Interpretation of Financial & Non-Financial Information

- Impact of Changes in Accounting Regulation

- Employability & Technology Skills

Course 13: Strategic Business Leadership

Demonstrate leadership, senior consultancy capabilities, and professional skills for organisational success.

Demonstrate leadership, senior consultancy capabilities, and professional skills for organisational success.

Topics Covered:

- Leadership & Governance

- Strategy & Risk Management

- Technology & Data Analytics

- Organisational Control & Audit

- Finance in Planning & Decision-Making

- Enabling Success & Change Management

Course 14: Advanced Financial Management

Gain an understanding of the knowledge and professional judgement expected of a senior financial executive in decision-making for organisations.

Gain an understanding of the knowledge and professional judgement expected of a senior financial executive in decision-making for organisations.

Topics Covered:

- Role of Senior Financial Adviser in Multinational Organisations

- Advanced Investment Appraisal

- Acquisitions & Mergers

- Corporate Reconstruction & Reorganisation

- Treasury & Advanced Risk Management Techniques

Course 15: Advanced Performance Management

Apply strategic management accounting techniques to enhance organisational planning, control, and performance evaluation.

Apply strategic management accounting techniques to enhance organisational planning, control, and performance evaluation.

Topics Covered:

- Strategic Planning & Control

- Performance Management Information Systems & Technology Developments

- Strategic Performance Measurement

- Performance Evaluation

Skills you'll acquire

This Masters in Accounting and Finance program is designed to equip you with a powerful combination of technical proficiency, strategic insight, and industry-relevant capabilities. Here's an in-depth look at the critical skills you’ll develop.

This Masters in Accounting and Finance program is designed to equip you with a powerful combination of technical proficiency, strategic insight, and industry-relevant capabilities. Here's an in-depth look at the critical skills you’ll develop.

- Financial Analysis and Reporting: Develop the ability to analyze financial statements using international accounting standards. Learn to create detailed reports that accurately reflect a company’s financial performance and support informed decision-making.

- Global Financial Management: Acquire skills to manage financial resources across international markets. Master techniques in capital budgeting, investment planning, and handling risks associated with fluctuating economies and currencies.

- Taxation Strategies: Understand how to evaluate global tax regulations and design efficient, compliant tax strategies for businesses operating in multiple regions. This skill is essential for minimizing liabilities and ensuring adherence to tax laws.

- Audit and Assurance: Learn how to conduct thorough audits and implement assurance practices to maintain the accuracy and integrity of financial records. Gain proficiency in identifying risks and ensuring compliance with international standards.

- Financial Analytics: Earn a PwC Academy Financial Analytics certification and enhance your ability to analyze financial data. Master visualization techniques and use data insights to drive smarter business decisions.

- Performance Management: Gain expertise in evaluating and improving organizational performance. Use management accounting methods to measure outcomes, analyze efficiencies, and support strategic planning.

- Corporate Governance and Ethics: Learn to apply ethical principles and corporate governance practices in financial operations. Ensure transparency, accountability, and ethical decision-making in all professional activities.

- Technology-Driven Financial Operations: Develop proficiency with modern financial tools to streamline processes and improve accuracy in financial analysis and reporting. Use technology to support strategic decisions and operational efficiency.

- Risk Management: Understand how to identify and manage financial risks in various business contexts. Gain skills to evaluate uncertainties and implement strategies to protect financial stability.

- International Financial Reporting Standards (IFRS): Master the application of IFRS in preparing and interpreting financial statements. This ensures your ability to work seamlessly in international accounting environments.

- Strategic Business Leadership: Develop financial leadership skills to make high-level strategic decisions. Learn to align financial strategies with organizational goals, manage teams effectively, and lead through complex challenges.

What Tools Will You Learn?

This Finance online degree, accredited with ACCA qualifications, provides hands-on experience with tools that support financial analysis, reporting, auditing, and strategic decision-making.

With the backing of JGU’s global curriculum and the upGrad learning platform, you will master the following tools used by top financial professionals worldwide.

- Financial Data Analysis Tools: Analyze and interpret large datasets to uncover key financial insights. These tools are crucial for evaluating performance, identifying trends, and supporting strategic decisions.

- Visualization Tools: Create interactive dashboards, charts, and reports to communicate financial data clearly and effectively. These tools help translate complex information into actionable insights.

- Audit and Assurance Software: Use tools that facilitate risk assessment, compliance checks, and auditing processes aligned with global standards. These tools ensure the accuracy and integrity of financial records.

- Performance Management Systems: Utilize systems to track organizational performance, set benchmarks, and analyze variances. These tools support efficient decision-making and strategic planning.

- Financial Reporting Tools: Prepare and analyze financial statements compliant with International Financial Reporting Standards (IFRS). These tools ensure your reports meet global compliance and consistency standards.

- Risk Management Platforms: Apply tools designed to identify, evaluate, and mitigate financial risks. These platforms are essential for protecting business stability and planning for uncertainties.

- Technology for Financial Operations: Work with technologies that automate financial processes, improve accuracy, and enhance operational efficiency. These tools cover everything from data entry to strategic analysis.

- Financial Analytics Tools (PwC Academy): Master data-driven financial analysis with tools provided through the PwC Academy Financial Analytics certification. These tools help visualize data, identify trends, and make informed decisions.

-f23b03c15ac6434d9080e7df93abe798.webp?width=720&quality=75)

Add-On PwC Certificate

Boost Your Resume with PwC Certificate

- Excel in Financial and Data Analytics

Master financial and data analytics concepts taught by PwC experts. - Learn Via Case Studies

Gain hands-on experience through real-world case studies. - Ace Excel and Power BI

Become proficient in Excel and Power BI for dynamic data insights and visualisation.

How is JGUs Online Master's Degree in Finance (Via upGrad) Different From Others?

JGUs finance online degree stands apart by offering a powerful blend of academic excellence, professional certifications, and global career pathways. With ACCA accreditation, industry-recognized credentials, and flexible learning, this MS in Finance program is designed to give you a competitive edge.

JGUs finance online degree stands apart by offering a powerful blend of academic excellence, professional certifications, and global career pathways. With ACCA accreditation, industry-recognized credentials, and flexible learning, this MS in Finance program is designed to give you a competitive edge.

Here’s a detailed comparison highlighting what sets this online master's in accounting program apart from others.

Comparison: JGUs MS in Finance Online (via upGrad) vs. Courses From Other Colleges

|

Feature

|

JGUs ACCA-Accredited Degree

(via upGrad)

|

Finance Programs From Other Colleges

|

|

Global Recognition

|

ACCA-integrated curriculum with the highest level of exemptions, recognized in 110+ countries

|

- Limited or no ACCA integration

- Fewer pathways to switch to finance careers.

|

|

Dual Credentials

|

- Master’s degree from JGU

- PwC Academy Certification |

Mostly single credential without additional industry certifications.

|

|

Industry-Relevant Curriculum

|

Curriculum aligned with ACCA standards and real-world financial practices.

|

Traditional finance curriculum with limited global relevance.

|

|

Flexible Learning Format

|

100% online with recorded lectures, weekend live sessions.

|

In-person or hybrid, requiring significant time commitments.

|

|

Global Networking

|

Access to students from 75+ countries and 475+ global partners.

|

Limited to regional or national student cohorts.

|

|

Program Duration

|

Complete in just 12 months while working.

|

At least 18-24 months, requiring longer commitments.

|

Program Fee: INR 2,75,000

The program is available at a limited-time launch fee, which includes comprehensive courses offering maximum ACCA paper exemptions, a PwC Academy certificate, and a clear pathway to earning dual credentials—an MSc in International Accounting and Finance, along with ACCA qualification.

The tuition fee is subject to annual revision effective April 2026.

International Accounting and Finance (Accredited by ACCA, UK)

How to Apply

The admissions process for the 1-year online Master’s from O.P. Jindal Global University is very easy, and can be done completely online.

Bachelor’s degree from a recognised university.

Take the 30-minute JFAAT Entrance Test

Students who have minimum 50% in graduation are exempted from JFAAT online entrance exam.

Students who have minimum 50% in graduation are exempted from JFAAT online entrance exam.

Read More

Block your seat and complete the payment

Pay the caution deposit to reserve seat and pay balance amount in 7 days.

Pay the caution deposit to reserve seat and pay balance amount in 7 days.

Read More

Complete document verification

Upload required educational documents to confirm your enrollment in the program.

Upload required educational documents to confirm your enrollment in the program.

Read More

Refer someone you know and receive cash reimbursements of up to

!*

Frequently Asked Questions

1. Is there an eligibility criteria for this program?

This program is open for learners with a valid undergraduate degree with 50% marks. Learners with <50% marks in their undergraduate degree need to give an admissions test.

This program is open for learners with a valid undergraduate degree with 50% marks. Learners with <50% marks in their undergraduate degree need to give an admissions test.

2. What kind of degree will I get after completing this program?

Post successful completion of this program, you will get an MSc. degree from Jindal Global University.

Post successful completion of this program, you will get an MSc. degree from Jindal Global University.

3. Can I do the Msc. program from my city?

You can learn this program from any city provided you are attending the classes scheduled.

You can learn this program from any city provided you are attending the classes scheduled.

4. Do I need to pay for claiming the exemptions for ACCA UK?

As per ACCA's guidelines, students who have not previously registered with ACCA will be eligible for the exemptions towards the ACCA exam papers and waiver of registration and exemption fees charged by ACCA. If a student is currently registered or has been registered in the past with ACCA, the student shall be eligible for availing the exam waivers, however the student shall be responsible for paying the exemption fee to ACCA. Neither upGrad nor the university will be held liable for these fees and/or any refund related thereto, under any circumstances.

As per ACCA's guidelines, students who have not previously registered with ACCA will be eligible for the exemptions towards the ACCA exam papers and waiver of registration and exemption fees charged by ACCA. If a student is currently registered or has been registered in the past with ACCA, the student shall be eligible for availing the exam waivers, however the student shall be responsible for paying the exemption fee to ACCA. Neither upGrad nor the university will be held liable for these fees and/or any refund related thereto, under any circumstances.

1. Will I be able to complete this programme being a busy working professional?

The program is specially designed for working professionals to enable effective learning while they continue their jobs/existing pre-dispositions. Apart from the face to face taught classes, the recorded content can be consumed on the website or mobile application on the go.

The program is specially designed for working professionals to enable effective learning while they continue their jobs/existing pre-dispositions. Apart from the face to face taught classes, the recorded content can be consumed on the website or mobile application on the go.

2. What kind of support does upGrad offer?

- Student Support is available 7 days a week, 24*7

- You can write to us via studentsupport@upgrad.com Or for urgent queries, use the "Talk to Us" option on the Learn platform

- Extensive academic support is provided through the Discussion Forum, Teaching Assistant-Sessions.

- Student Support is available 7 days a week, 24*7

- You can write to us via studentsupport@upgrad.com Or for urgent queries, use the "Talk to Us" option on the Learn platform

- Extensive academic support is provided through the Discussion Forum, Teaching Assistant-Sessions.

1. What is the refund and deferral policy for this programme?

Refund Policy:

1. You can claim a refund for the amount paid towards the Program within the duration mentioned on the Offer Letter, by visiting www.upgrad.com and submitting your refund form via the "My Application" section under your profile. You can request your Admissions Counsellor to help you in applying and withdrawing for a refund by sending them an email with reasons listed. There shall be no refund applicable once the program has started. This is applicable even for those students who could not complete their payment, and could not be enrolled in the batch opted for. However, the student can avail pre-deferral as per the policy defined below for the same.

2. Student must pay the full fee within seven (7) days of payment of the deposit amount or batch start date, whichever is earlier; otherwise, the admission letter will be rescinded.

3. Request for refund as per point no. 1 of the refund policy must be sent via email in the prescribed refund request form. The refund will be processed within 30 working days of submitting the duly signed refund form, after being duly approved by the Academic Committee.

Refund Policy:

1. You can claim a refund for the amount paid towards the Program within the duration mentioned on the Offer Letter, by visiting www.upgrad.com and submitting your refund form via the "My Application" section under your profile. You can request your Admissions Counsellor to help you in applying and withdrawing for a refund by sending them an email with reasons listed. There shall be no refund applicable once the program has started. This is applicable even for those students who could not complete their payment, and could not be enrolled in the batch opted for. However, the student can avail pre-deferral as per the policy defined below for the same.

2. Student must pay the full fee within seven (7) days of payment of the deposit amount or batch start date, whichever is earlier; otherwise, the admission letter will be rescinded.

3. Request for refund as per point no. 1 of the refund policy must be sent via email in the prescribed refund request form. The refund will be processed within 30 working days of submitting the duly signed refund form, after being duly approved by the Academic Committee.

upGrad Learner Support

Monday to Saturday | 24 Hours.

*All telephone calls will be recorded for training and quality purposes.

*If we are unavailable to attend to your call, it is deemed that we have your consent to contact you on purpose.